It will uncover current and future market trends and show how much you could be earning. While there is no correct answer, you can use an Airbnb cal c ulator to help estimate your potential income and determine if you will have enough return on your investment. Your potential earnings will vary depending on location, seasonality, maximum occupancy, etc. If you are a beginner host, you might find it difficult to calculate how much you can with Airbnb or VRBO. This is why GOI factors in vacancy and credit losses against potential rental income. It would be great if a rental property was completely leased, but this isn’t likely. This number is easy to find because real estate investors often think in terms of the “best-case scenario”. Potential Rental Income (PRI) is how much you’d make if the property was leased 100% of the time. Gross Operating Income = Potential Rental Income – Vacancy Rate To calculate NOI accurately, first, you need to calculate your Gross Operating Income (GOI): You need to know, however, that this number will fluctuate based on market decisions and property management.

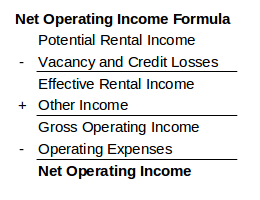

It means the total rental income generated from renting out your property. Net Operating Income = Gross Operating Income – Operating Expenses Gross Operating Income So, we have the following equation for calculating Net Operating Income: After all, to get to a company’s NOI, simply subtract operating expenses from the Gross Operating Revenue that was generated.

The Net Operating Income formula is perhaps one of the easiest equations for the property owner to understand. Thus, it is possible to understand why many real estate investors consider NOI as a “synonym” for EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) since they have several similarities. It is important to note that Net Operating Income is a pre-tax number on the income statement and it excludes loan interest payments, capital expenditures, depreciation, and amortization. In other words, NOI will indicate to real estate investors if the rental income generated from the property is worth the cost. Therefore, NOI in real estate is like a financial health certificate for a property. It equals all revenue generated by the property, minus all necessary operating expenses. The Net Operating Income (NOI) is a financial indicator that is used to analyze the profitability of real estate investments.

#Calculating noi real estate how to#

Read on to understand what NOI in real estate is, how to calculate it, and what it can be used for. Some real estate formulas - like NOI - will help you estimate the degree of risk posed by your investment.

Of course, there are no guarantees that your investment will pay off, but there are several ways you can assess the risk. While a successful investment may take your business to the next level, a flop could mean loads of debt and an empty house. See below for some of the most common line items used in the Operating Expenses calculation: Operating Expenses = Insurance + Property Taxes + Maintenance + Utilities + Property Management Fees + Other Costs (Administrative, Advertising, Salaries, Etc.When it comes to investing your money in properties for vacation rentals, it is important to research the market and be fully aware of the risks involved. Operating Expenses don’t include debt service, income tax, depreciation, tenant improvements, commissions, and capital expenditures. These expenses are paid by the landlord and not by the tenants.

See below for the calculation for GOI: Gross Operating Income = Potential Rent Income – Vacancy & Credit Losses + Other Income (Parking Fees, Service Charges, Etc.) Operating Expenses are costs that are directly related to operating the property. If equipment used by the property or even the property itself is sold, these line items would not be considered in this calculation. How to Calculate Net Operating Income We can calculate the Net Operating Income by using the formula below: Net Operating Income = Gross Operating Income – Operating Expenses Gross Operating Income (GOI), also known as Effective Gross Income (EGI), is the amount of revenue directly generated by operating the property.

0 kommentar(er)

0 kommentar(er)